EV Tax Credit*

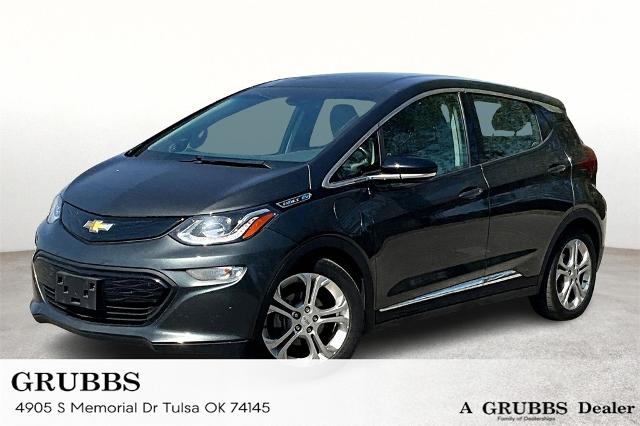

2020 Chevrolet Bolt EV 5dr Wgn LT

- Offer Amount $4000

- Price: $10,000*

- Stock Number: L4107046

The $4,000 Electric Vehicle (EV) Tax Credit is subject to the regulations and guidelines set forth by the relevant government authorities.

Offer Disclosure

*The $4,000 Electric Vehicle (EV) Tax Credit is subject to the regulations and guidelines set forth by the relevant government authorities. This disclaimer serves to inform potential beneficiaries of certain important points regarding eligibility and conditions associated with claiming the tax credit:

Eligibility Criteria: To qualify for the $4,000 EV Tax Credit, individuals must meet specific eligibility criteria as determined by the governing tax authority. This may include factors such as the type of vehicle purchased, its battery capacity, and the purchaser's tax liability.

Tax Liability: The $4,000 EV Tax Credit is non-refundable, meaning it can only reduce the amount of tax owed to zero. If an individual's tax liability is less than $4,000, they may not be able to fully benefit from the entire credit amount.

Phase-Out Threshold: The EV Tax Credit may be subject to phase-out thresholds based on the number of electric vehicles sold by a manufacturer. Once a manufacturer reaches the designated threshold, the tax credit for their vehicles may begin to decrease or phase out entirely over time.

Consultation with Tax Advisor: Individuals considering claiming the EV Tax Credit are encouraged to consult with a qualified tax advisor or accountant to assess their eligibility and understand the potential impact on their tax situation. Tax laws and regulations are subject to change and interpretation, and professional advice can provide clarity and ensure compliance.

Documentation and Reporting: Claimants must retain all necessary documentation related to the purchase of the electric vehicle and the claimed tax credit. This documentation may be required to substantiate the claim and may need to be provided upon request by the tax authorities.

Limitations and Exclusions: The $4,000 EV Tax Credit may not be applicable in certain jurisdictions or under specific circumstances. Additionally, certain types of electric vehicles, such as plug-in hybrids or electric motorcycles, may have different eligibility criteria or credit amounts.

Validity Period: The information provided in this disclaimer is based on current regulations and guidelines as of [current date]. Tax laws and incentives are subject to change, and individuals should verify the latest updates from the relevant tax authority or government agency.

Responsibility of the Claimant: Claiming the $4,000 EV Tax Credit is the responsibility of the taxpayer, and they are accountable for ensuring compliance with all applicable laws and regulations. Any errors or discrepancies in claiming the tax credit may result in penalties or fines imposed by the tax authorities.

Acura, INFINITI, and Volvo Specials

Explore the Acura, INFINITI, and Volvo lease specials and finance offers available now at a Grubbs dealership near you. We provide our Texas Acura, INFINITI, and Volvo lease customers with attractive offers on all of their favorite new models. If you are planning to purchase your new vehicle, we also have competitive finance offers, making your choice just a little bit easier. View Acura, INFINITI, and Volvo deals above for current Grubbs specials and click on one the offers listed for more details. If you have questions about these deals or you'd like to take advantage of on of these right away, call us at 817-527-8103 or contact us online. You can also view our inventory of new INFINITI or new Nissan vehicles for sale to select the vehicle that has all of the features you're searching for. Enjoy these special offers at any of our Grubbs dealership locations.